Published on 04.08.2017 14:46

The gold price is directionless in today’s trading as the market awaits one of the biggest economic releases of the year, which is expected to be the driver of monetary policy in the US for the nearest future.

The Non-farm payrolls figure and unemployment rate from the US are due out later today and depending on the figures, gold is likely to continue its uptrend or face severe pullback.

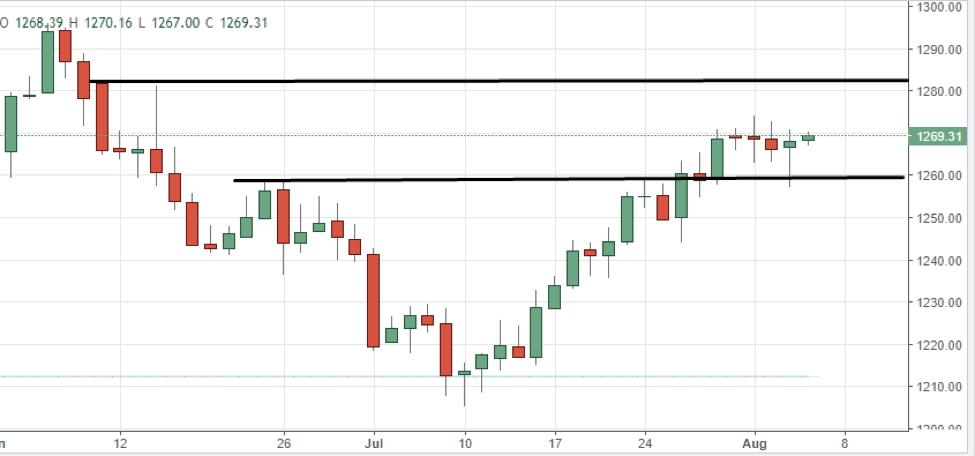

Strong numbers may help the US Federal Reserve raise interest rates next month, which is seen as negative for gold as it is not an interest bearing investment and we may see a pullback to the former resistance level of $1,260.

Should the figures disappoint the market gold is expected to make its way towards the $1,280 mark where it may face some headwinds.